All Categories

Featured

Table of Contents

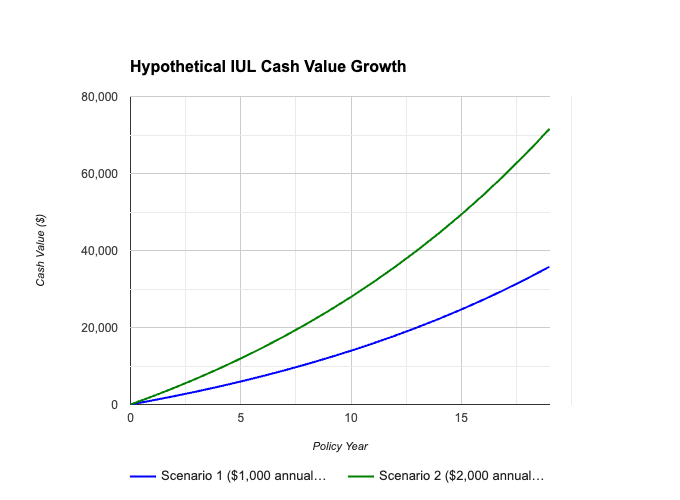

Below is a hypothetical contrast of historic efficiency of 401(K)/ S&P 500 and IUL. Allow's assume Mr. SP and Mr. IUL both had $100,000 to conserved at the end of 1997. Mr. SP spent his 401(K) money in S&P 500 index funds, while Mr. IUL's money was the cash money worth in his IUL plan.

IUL's policy is 0 and the cap is 12%. After 15 years, at the end of the 2012, Mr. SP's profile grew to. Since Mr. IUL never shed money in the bear market, he would have twice as much in his account Also better for Mr. IUL. Since his cash was conserved in a life insurance policy, he does not need to pay tax! Certainly, life insurance policy shields the family members and supplies sanctuary, foods, tuition and clinical expenditures when the insured dies or is seriously ill.

National Life Iul

The plenty of choices can be mind boggling while researching your retirement spending alternatives. Nonetheless, there are particular decisions that must not be either/or. Life insurance pays a survivor benefit to your recipients if you ought to pass away while the plan holds. If your family members would deal with economic challenge in the event of your death, life insurance policy provides tranquility of mind.

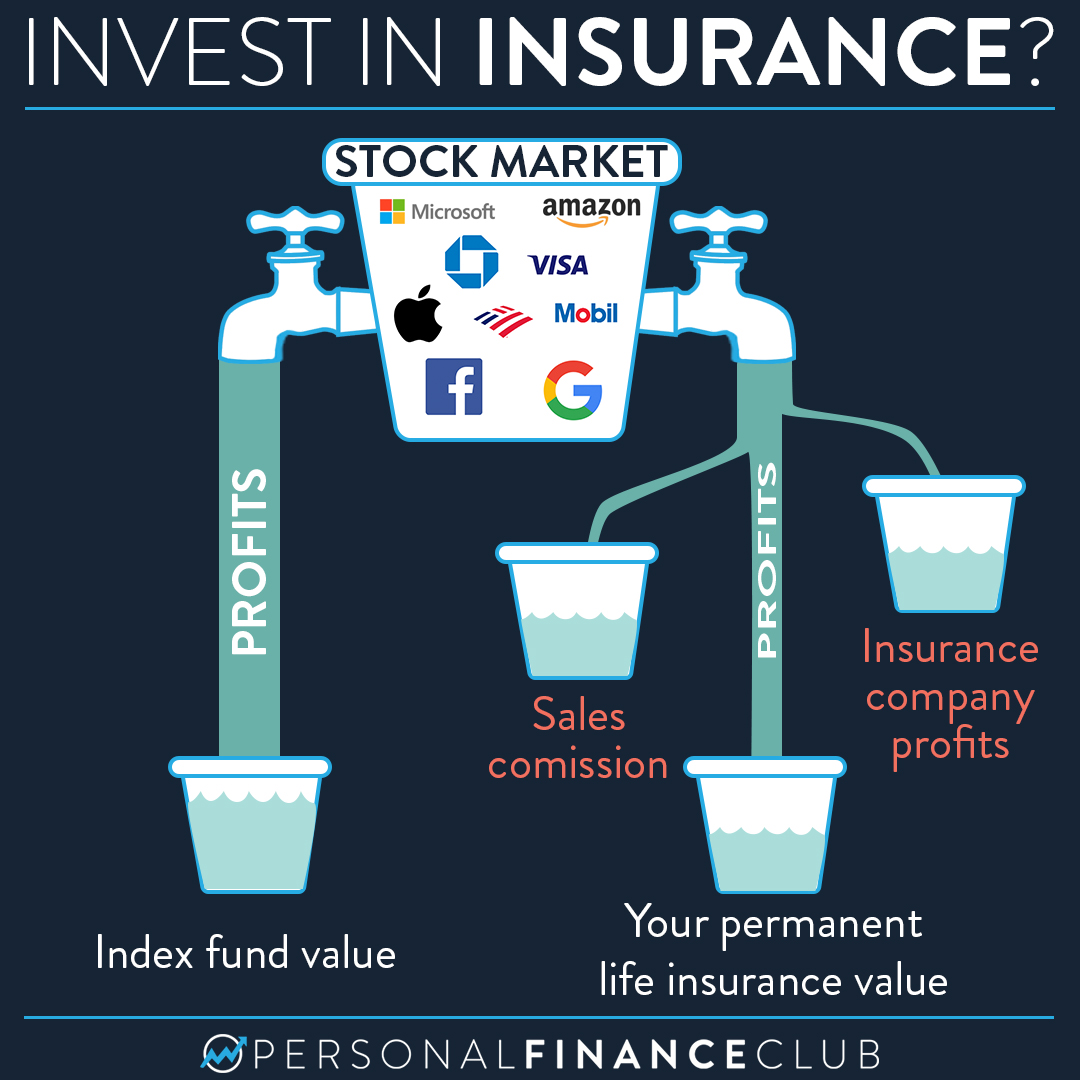

It's not one of one of the most successful life insurance policy financial investment strategies, however it is just one of one of the most protected. A type of irreversible life insurance policy, global life insurance coverage enables you to pick how much of your costs approaches your survivor benefit and just how much enters into the policy to accumulate cash money worth.

In addition, IULs enable insurance policy holders to get finances against their policy's cash money worth without being tired as revenue, though unsettled balances might be subject to tax obligations and charges. The primary benefit of an IUL policy is its potential for tax-deferred growth. This indicates that any earnings within the policy are not taxed up until they are withdrawn.

Alternatively, an IUL policy might not be the most ideal financial savings plan for some individuals, and a conventional 401(k) might prove to be a lot more useful. Indexed Universal Life Insurance Policy (IUL) plans supply tax-deferred development potential, security from market slumps, and death advantages for beneficiaries. They enable insurance policy holders to make interest based upon the efficiency of a stock market index while protecting against losses.

Transamerica Corporation Iul

Companies may additionally use matching payments, better enhancing your retired life savings possibility. With a traditional 401(k), you can minimize your taxed income for the year by contributing pre-tax bucks from your paycheck, while likewise benefiting from tax-deferred development and employer matching contributions.

Many employers additionally give matching payments, effectively giving you free cash towards your retirement. Roth 401(k)s feature in a similar way to their standard equivalents yet with one trick distinction: tax obligations on payments are paid upfront instead of upon withdrawal throughout retirement years (national life iul). This implies that if you anticipate to be in a greater tax obligation bracket throughout retired life, adding to a Roth account could reduce tax obligations with time compared to spending entirely through standard accounts (resource)

With reduced management fees typically contrasted to IULs, these sorts of accounts permit investors to conserve money over the long term while still benefiting from tax-deferred growth possibility. Additionally, numerous prominent low-priced index funds are offered within these account types. Taking circulations before getting to age 59 from either an IUL plan's cash money value through fundings or withdrawals from a typical 401(k) plan can result in negative tax obligation effects otherwise handled carefully: While borrowing versus your policy's money worth is typically thought about tax-free as much as the quantity paid in costs, any unsettled loan balance at the time of death or policy surrender may be subject to revenue tax obligations and fines.

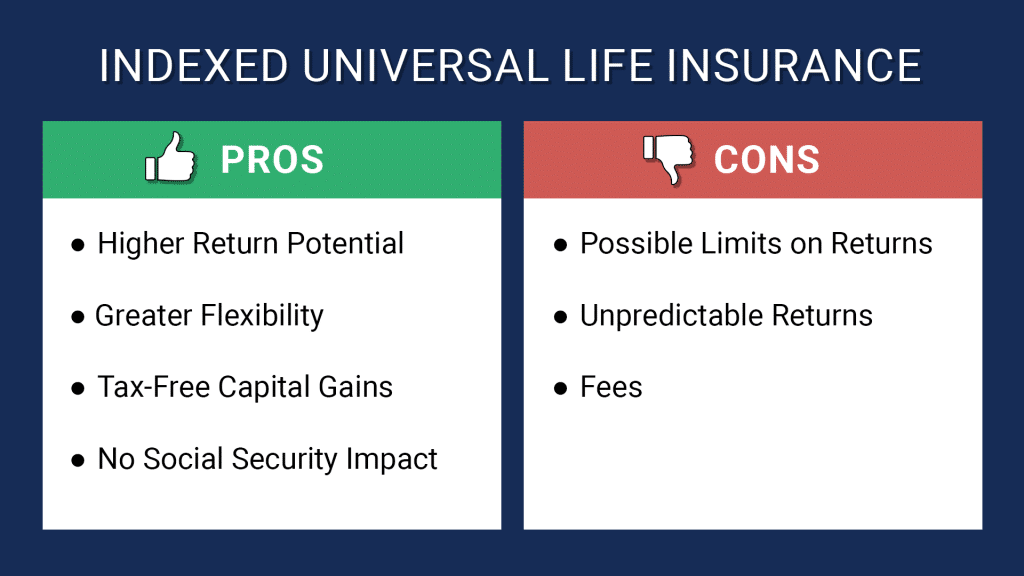

Iul Insurance Pros And Cons

A 401(k) provides pre-tax financial investments, employer matching payments, and possibly even more investment choices. iul sa. Talk to a financial organizer to identify the very best alternative for your situation. The downsides of an IUL include greater administrative prices compared to standard retired life accounts, constraints in investment choices as a result of plan constraints, and possible caps on returns throughout solid market performances.

While IUL insurance might verify beneficial to some, it's important to recognize how it functions before purchasing a policy. Indexed global life (IUL) insurance policy policies offer higher upside possible, versatility, and tax-free gains.

firms by market capitalization. As the index goes up or down, so does the rate of return on the cash value component of your plan. The insurer that releases the policy might offer a minimal guaranteed price of return. There may also be a top limit or rate cap on returns.

Economists typically recommend having life insurance coverage that's comparable to 10 to 15 times your yearly revenue. There are a number of disadvantages connected with IUL insurance coverage plans that critics fast to point out. A person who establishes the policy over a time when the market is performing badly can finish up with high costs repayments that do not contribute at all to the cash worth.

Besides that, bear in mind the adhering to other factors to consider: Insurance companies can set participation prices for how much of the index return you obtain annually. Let's say the plan has a 70% involvement price. If the index expands by 10%, your cash money value return would be just 7% (10% x 70%)

Additionally, returns on equity indexes are often capped at a maximum amount. A policy may say your maximum return is 10% each year, regardless of just how well the index does. These restrictions can restrict the real rate of return that's credited toward your account annually, no matter how well the plan's hidden index does.

Iul Divo

It's vital to consider your individual threat tolerance and financial investment objectives to make certain that either one lines up with your general technique. Whole life insurance policy plans typically include an assured rate of interest rate with foreseeable premium amounts throughout the life of the policy. IUL policies, on the various other hand, offer returns based upon an index and have variable costs in time.

There are several various other types of life insurance policy policies, explained listed below. offers a fixed advantage if the insurance holder passes away within a set time period, generally in between 10 and three decades. This is one of one of the most budget friendly sorts of life insurance coverage, as well as the most basic, though there's no cash money value build-up.

Indexed Universal Life Vs 401k Retirement Options

The plan gets worth according to a fixed schedule, and there are fewer costs than an IUL policy. A variable policy's cash money worth may depend on the efficiency of specific supplies or other securities, and your costs can also change.

Table of Contents

Latest Posts

Index Insurance

Is Universal Life Whole Life

Buy Iul

More

Latest Posts

Index Insurance

Is Universal Life Whole Life

Buy Iul